Analysing differences in energy costs for the EU metallurgical industry

Energy costs are generally the largest part of the cost structure of large industrial companies, making it a critical factor in deciding where to locate their plants to gain a strong position in a market characterized by fierce global competition.

In this study, we examine differences among a number of EU countries in the costs incurred by large industrial consumers for their annual energy consumption.

Background

Cost differences arise because large consumers in different countries pay different prices for the energy they consume. These price differences result from country-specific pricing policies (such as taxes, exemptions and grid tariffs and from differences in wholesale prices (commodities). The energy price consists of a commodity price and several non-commodity-related components (e.g., taxes and grid charges). In this study, we focus on the international differences between the non-resource-related price components; specifically energy and climate-related taxes, grid tariffs and value-added taxes.

Key findings

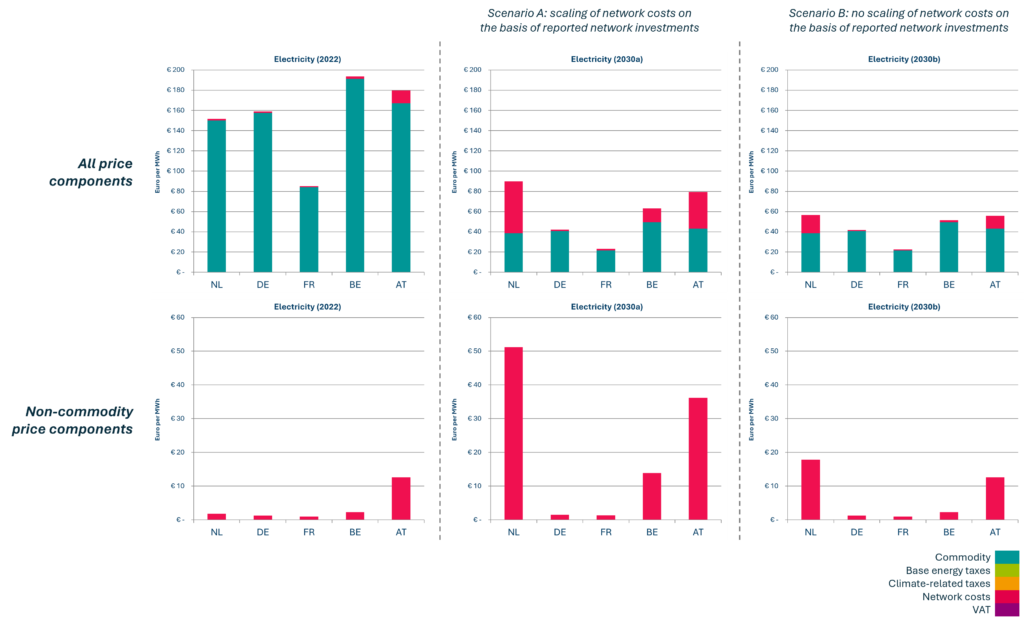

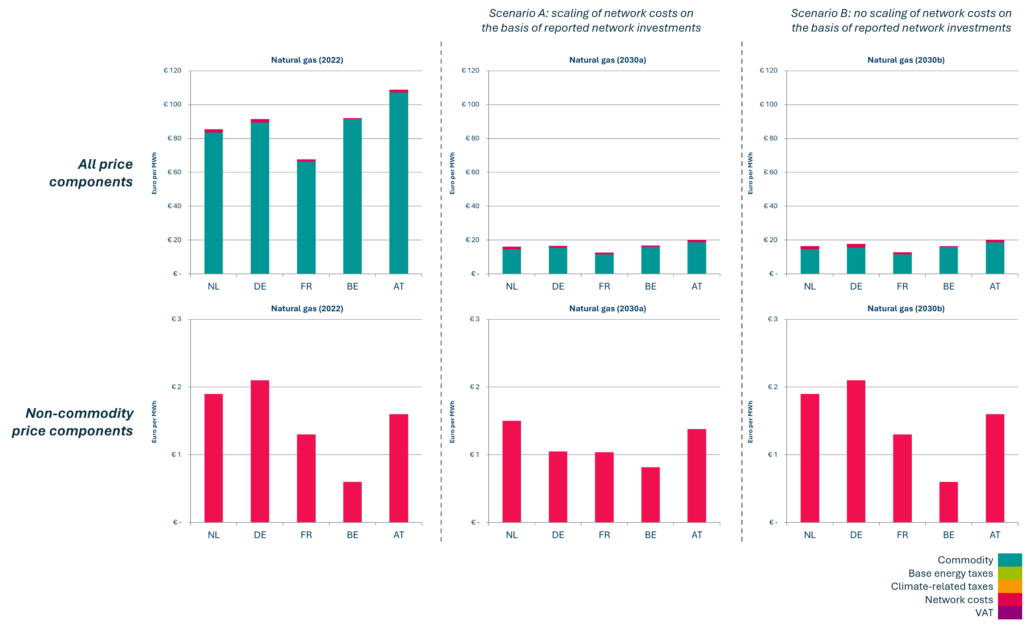

In our study, we find that the metallurgical industry is eligible for tax exemptions in all EU countries studied. Therefore, there are no effective differences between countries in terms of taxes levied (whether basic energy taxes, climate-related taxes or value-added taxes). The observed price differences are therefore entirely due to differences in the network costs charged. Since the differences in network charges are relatively small, it can be concluded that an almost level playing field currently exists between the countries analysed.

Looking ahead, we expect that changes in energy costs will mainly result from shifts in network tariffs and the discontinuation of tax exemptions by certain countries. Taking into account both announced and expected policy changes as well as planned grid investments by national grid operators (TSOs), we foresee an overall increase in energy costs for the metallurgical industry in the EU countries studied by 2030. The Netherlands will have the largest cost increase in relative terms.

Electricity price overview large consumers after exemptions and reductions

Overview gas price wholesale customers after exemptions and reductions

The price developments we have outlined are largely dependent on the development of European policies. For example, if revisions to the European Energy Taxation Directive (ETD) lead to stricter standards for levying energy taxes in the EU, it can be expected that countries other than the Netherlands will also abolish certain tax exemptions. This will ultimately lead to a more level playing field for industrial energy consumers within the EU.

Would you like to discuss the results of this study with us? If so, please contact us!

30 October 2023

2 minute read

Sectors

Key Experts

Kurt Kreulen

Consultant

Maurice Thijsen

Senior Consultant